How Coronavirus Affected the Forex Market

As the main driver of the currency market, how will the US dollar react as the chaos from the COVID-19 pandemic impacts the global economy? Forex markets have remained relatively stable (compared to stocks and commodities) since the virus outbreak, but will this continue? Unfortunately, the final outcome remains unknown because governments, corporations, and private citizens are still unable to quantify the total effects as the pandemic takes its toll.

Initial Market Impact and the Federal Reserve’s Response

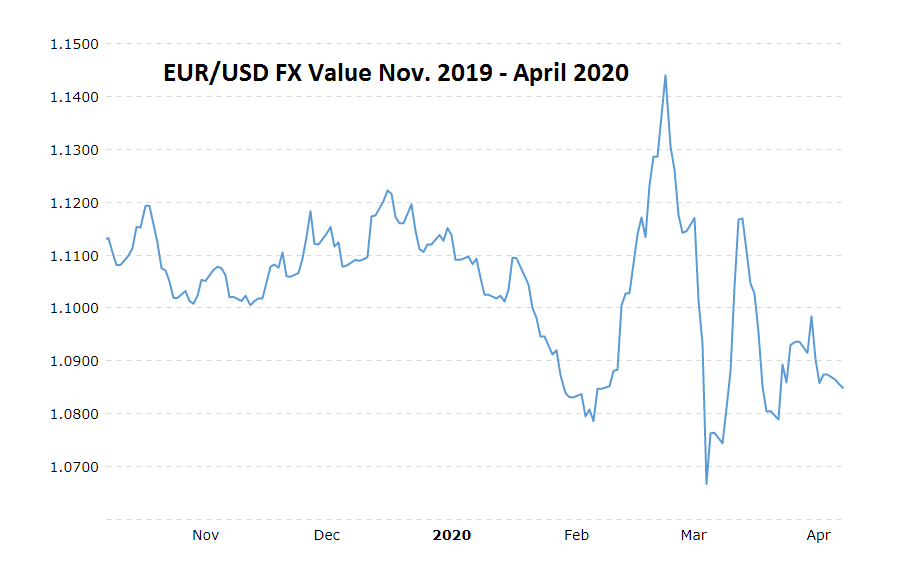

The relatively stable performance of the EUR/USD pair saw the Euro gain value in February as concerns about a global pandemic grew, especially when Italy became the epicenter. The Euro weakened once it became clear that the US Federal Reserve would respond to the growing threat. By mid-March 2020, the US central bank’s move to near-zero interest rates brought the EUR/USD pair back to February values, around 1.08 – 1.10 on the Forex market.

The Federal Reserve’s rapid rate cut during the initial shock of the pandemic was notable, although it lacked a clear fiscal program from the US government. Unfortunately, the fiscal stimulus programs in the US may prove inadequate, as disappointing revenues and non-performing loans are likely to emerge. Concerns about a second wave of coronavirus infections and the potential for immunity passports persist and remain unchanged.

Estimating the Economic Cost of the Pandemic

Estimating the potential total cost of the pandemic remains challenging for most experts, as businesses and economies are suffering. Revenues, debt, and risks remain difficult to resolve, casting a shadow over the Forex market, while other key areas of the financial world falter. In April, the energy sector’s results were extraordinary as crude oil, particularly through WTI futures contracts, was decimated due to evaporating demand, making consumption forecasts difficult to calculate.

The Federal Reserve’s Struggle for Normalcy

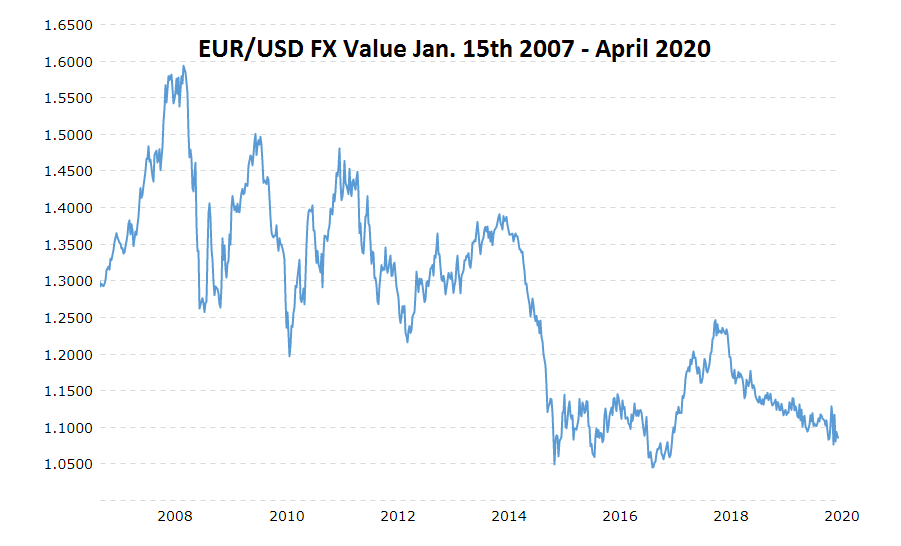

The EUR/USD pair has experienced a relatively steady downward price progression over the past six years, as the European Central Bank has shown its inability to raise interest rates compared to the US Federal Reserve. The Fed had been trying to create higher interest rates to accumulate enough tools to manage an economic crisis. However, by spring 2019, the Fed’s strong rhetoric about trying to bring its prime lending rate to a higher level began facing political and economic obstacles.

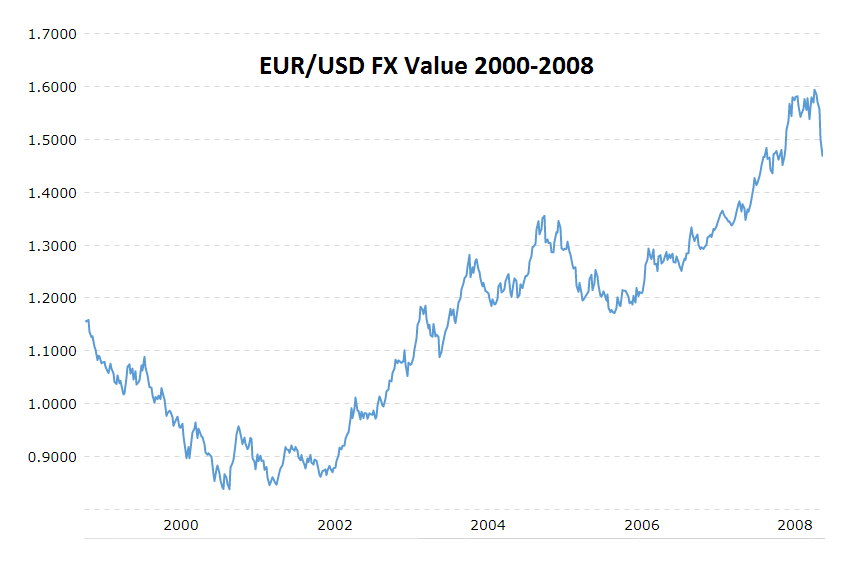

As a result, the Fed started to lower its interest rate in 2019, helping sustain the momentum of the US economy. The coronavirus pandemic has since changed the global economic outlook, and the basic assumptions of central banks have been swept away. The Fed’s stimulus policies expose the US central bank to vulnerabilities it likely cannot foresee. Since the 2007-08 financial crisis, the USD has maintained a generally strong upward trend.

The US Dollar as a Safe-Haven Asset

During the COVID-19 pandemic, it’s likely that the USD will continue to hold its status as a safe-haven asset in times of extreme risk. In the short and medium term, I remain confident in a relatively strong dollar. However, my long-term outlook is more uncertain. Critics of the USD argue that it shouldn’t be considered a safe haven, but the question remains: Which other currency would you trust more in the Forex market?

The value of the dollar derives from trust in the government backing it. Do you trust European governments and the European Central Bank more than the US during the pandemic? While the US, led by Trump, may seem chaotic rhetorically, it has a unified central system working towards the same goal of restoring the country.

The European Central Bank’s Struggle with Fiscal Unity

The premise that the Euro would be valued more than the Dollar was prevalent until the 2007-08 financial crisis. However, when central banks were called to rescue the devastation caused by failed financial institutions, it became evident that there was a lack of fiscal unity within the European Union. This lack of transparency among EU members contributed to the EUR’s persistent decline against the USD for over a decade.

The question remains whether the EUR can claim to have a unified framework under the EU. It appears that political disharmony within the EU is more focused on protecting national economies rather than a collective fiscal policy. This, combined with Germany’s reluctance to support a unified bond in 2020, highlights the fragility of the EU’s fiscal structure.

Future Uncertainty for the US Dollar and Global Economy

The future of the dollar and global capitalism are under threat. The April 2020 crash in crude oil prices was a key indicator of the global economy’s fragility. The US is poised to enter a rough economic cycle, and the full extent of the damage is not yet fully understood. In the immediate future, concerns over mortgages, rent payments, auto loans, and credit card bills will dominate, as businesses and workers struggle with financial instability. The long-term effects on the US dollar are unclear, and there is growing fear that the currency may weaken over time as governments continue to print money to cover debts.